Market Drivers:

• The expectation (based on average trade guesses) that the USDA will reduce its US corn and soybean yield forecasts in tomorrow’s (Thursday) WASE report

• The expectation (based on average trade guesses) that the USDA will reduce its World and US corn and soybean stocks in tomorrow’s (Thursday) WASE report

• Concern of the impact an early frost would have on crop yield – gets less as time moves closer to harvest

• A widely variable U.S. crop

Great Lakes Grain, AGRIS Co-operative, FS PARTNERS Crop Assessment Tour Report• Estimated this year’s average corn yield across the southwest and central part of Ontario at 160.8 bushels/acre and the soybean yield at 45.6 bushels/acre

• This compares to last month’s Statistics Canada projections of 154.8 bushels/acre for corn and 43 bushels for soybeans for the whole province as opposed to the regions assessed by Great Lakes Grain

• Check out the report at http://aghost.net/images/e0015001/GreatLakesGrain2013CropAssessmentTourSummarySeptember102013.pdf

• Provides more detailed yield information and crop conditions observed during the tour held from September 3rd to 6th

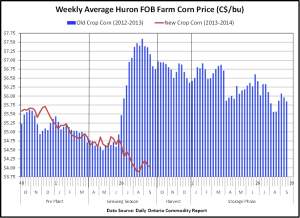

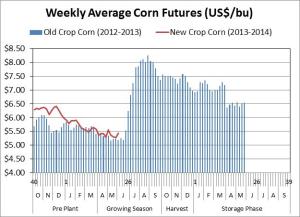

The above graph is based on weekly average Huron FOB Farm corn market prices:

- It compares old crop corn (2012-2013) being sold out of storage (blue bars) with new crop corn (2013-2014) that will be harvested this fall (red line)

- The time period shown for each crop year is a two year period from pre-plant, growing season, harvest and storage

- The old crop corn is from October 2011 to September 2013 and the new crop corn is from October 2012 to September 2014

Disclaimer: This commentary is provided for information only and is not intended as advice